Proposed TAX will make Lithium in California a Non-starter

With Lithium demand rising, California is positioned to be a global leader in sustainably produced Lithium to support electric vehicles and battery storage. A CA tax without flexibility for pricing will depress needed investment.

TAKE ACTION NOW

Take just 30 seconds to use the form on the right and send an impactful message of support for Lithium in California.

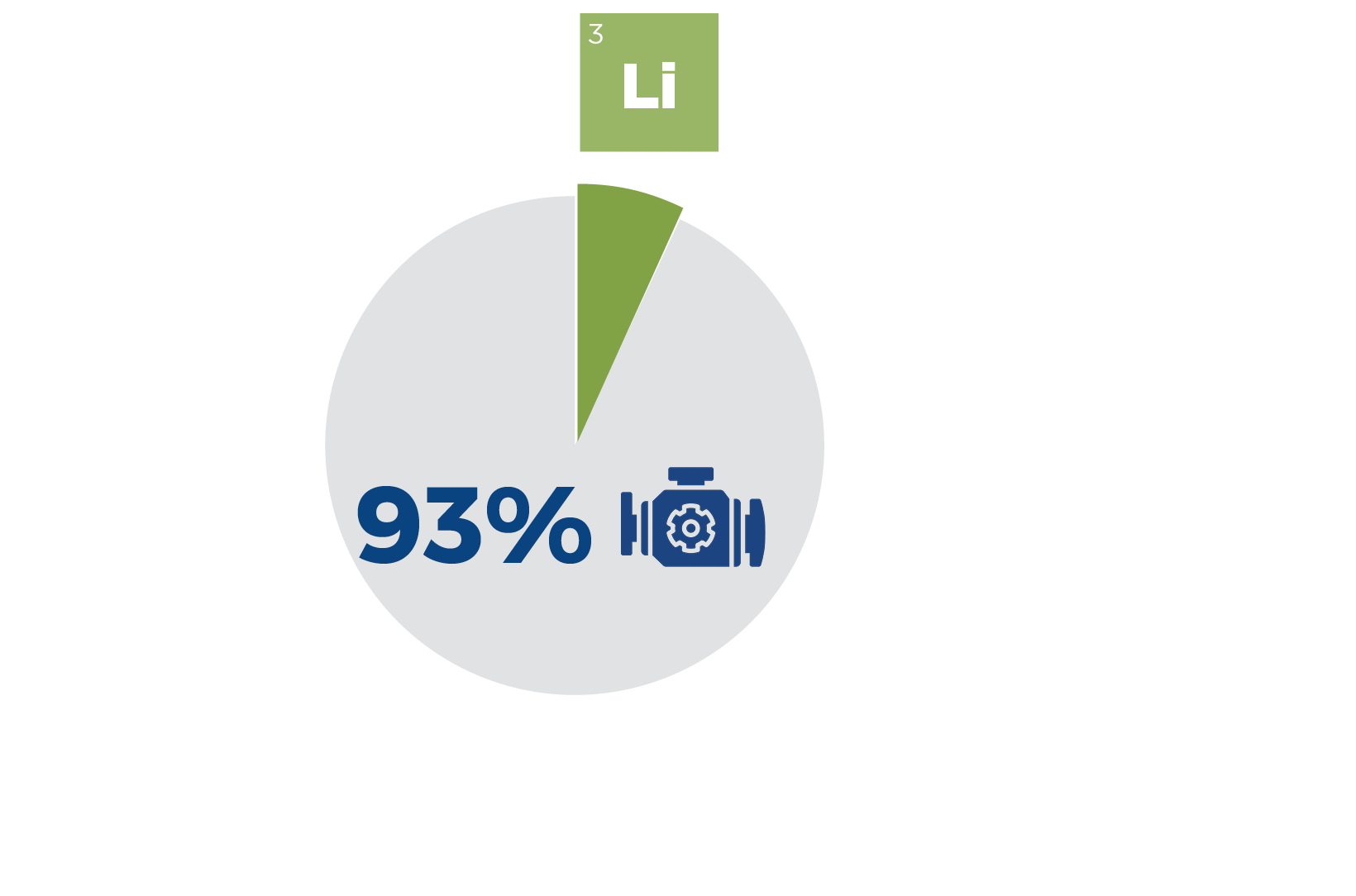

Demand

for Lithium is rising

Lithium is the essential raw material for electric vehicles and enables more renewable energy with battery storage.

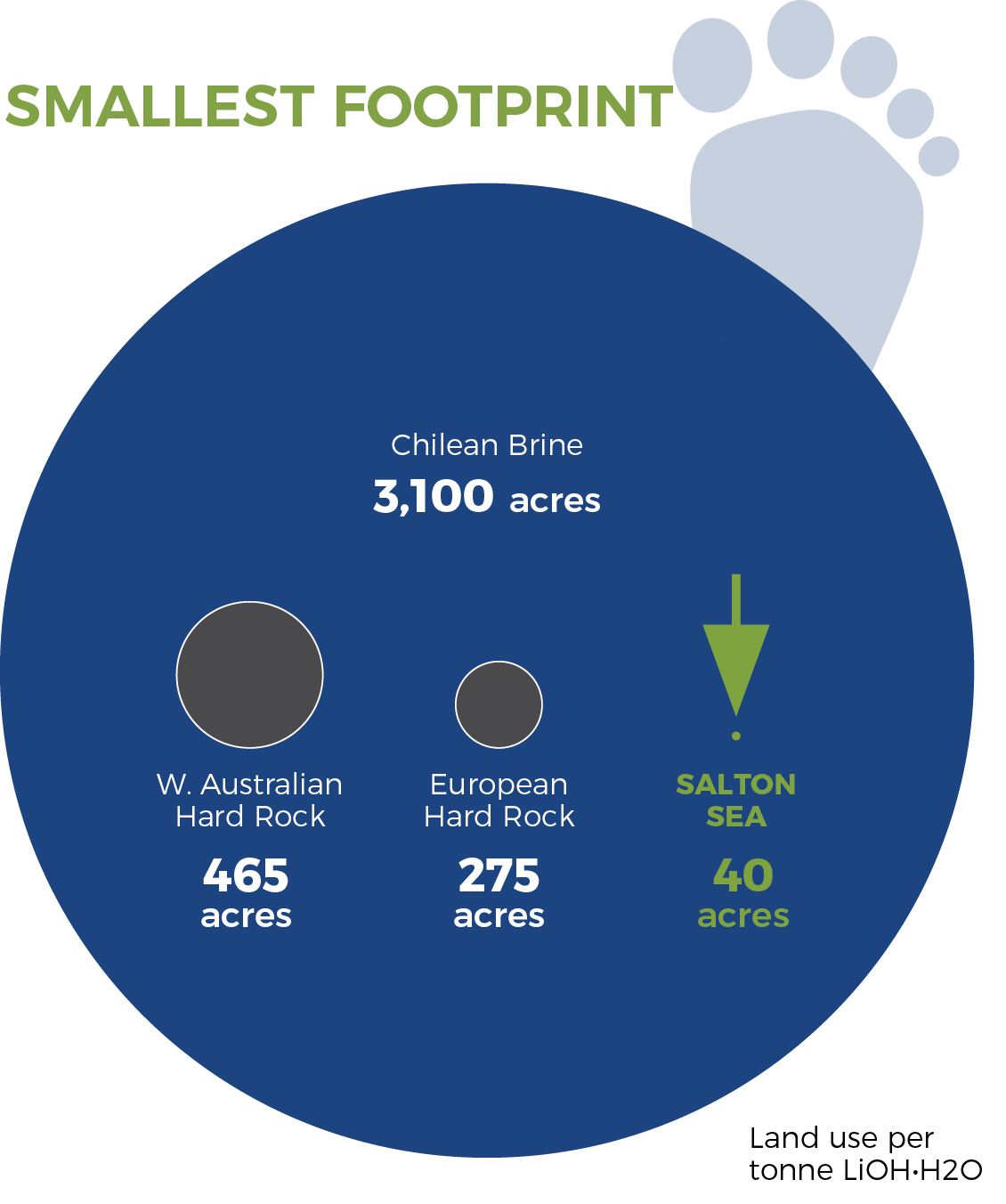

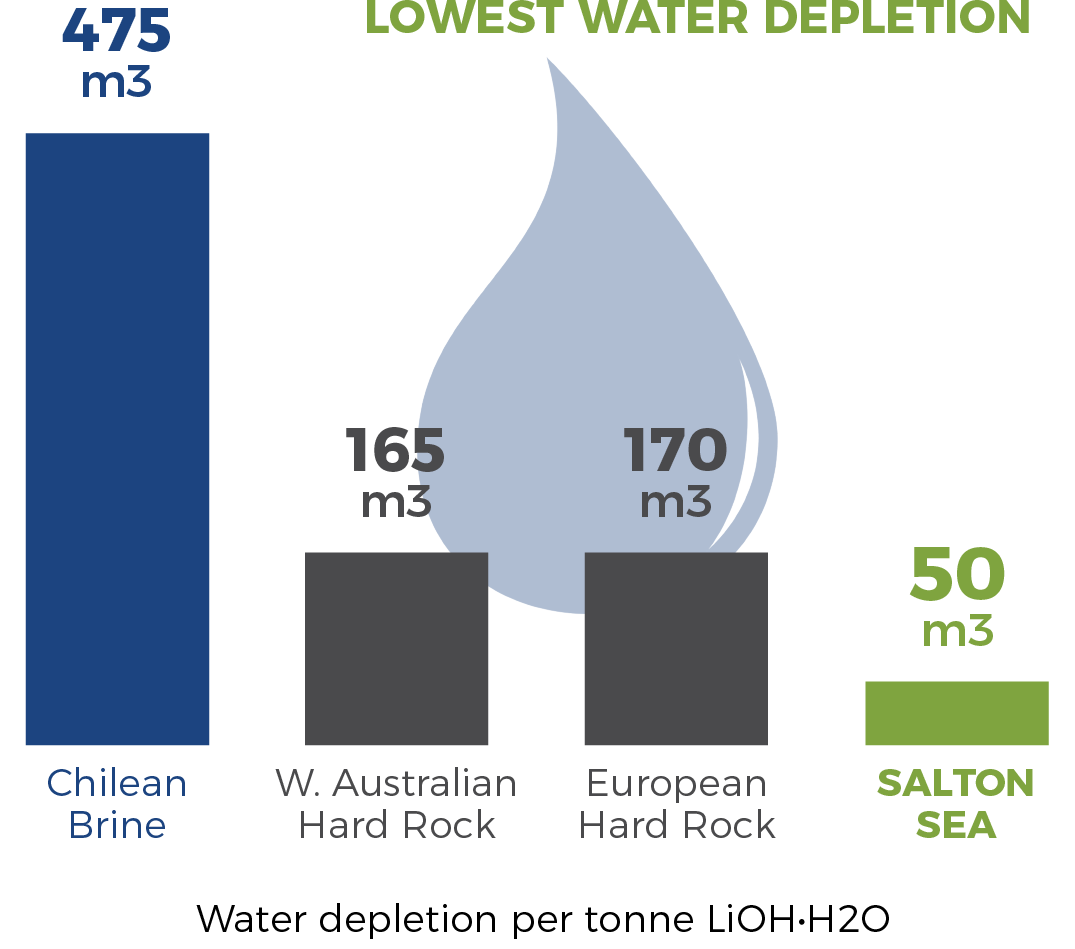

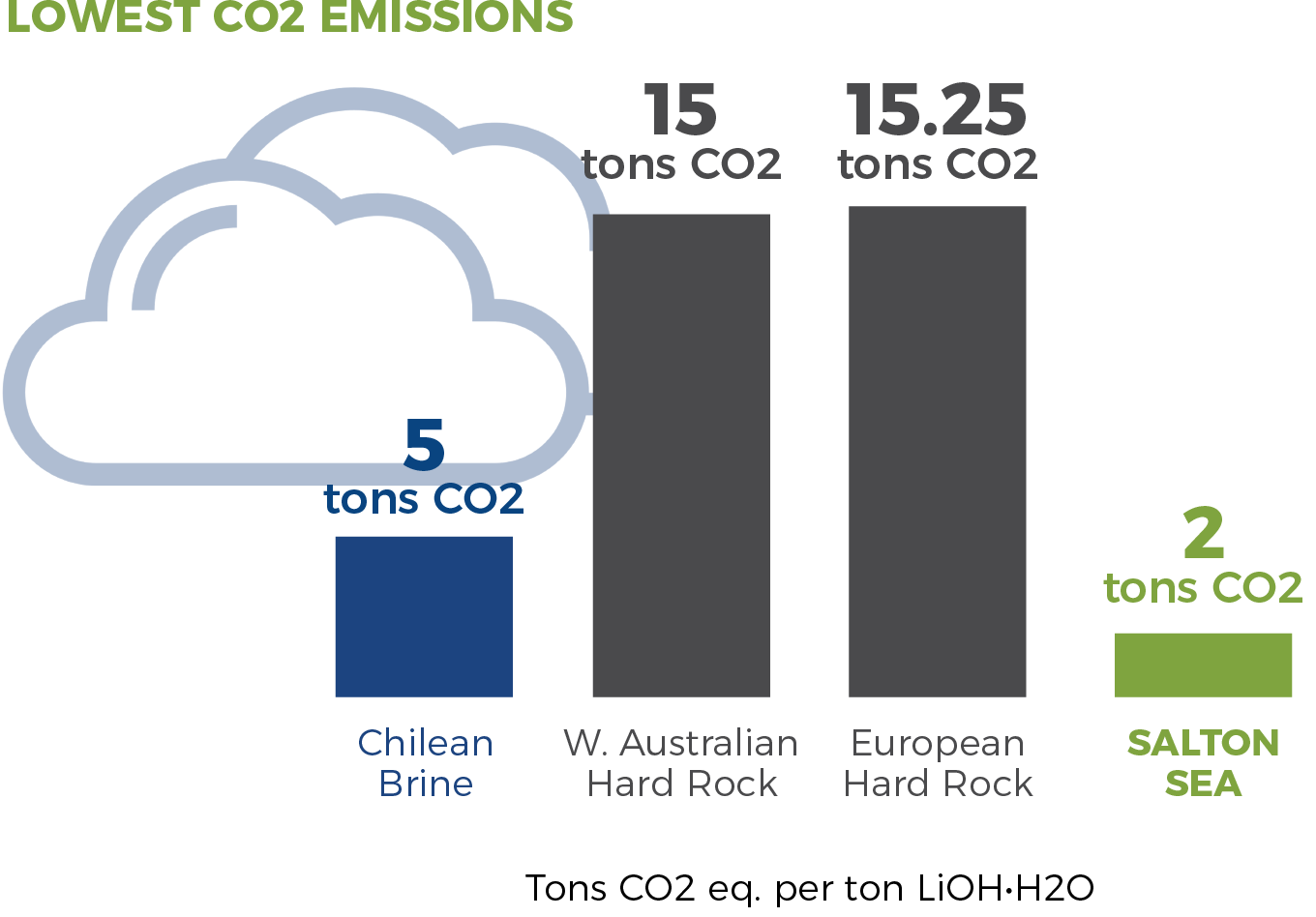

California Lithium from brine has smallest environmental footprint

The Salton Sea offers the opportunity to process brine and extract lithium with the LOWEST WATER DEMAND AND CARBON EMISSIONS, and SMALLEST FOOTPRINT of any of the leading lithium mining operations across the world.

California tax proposal would greatly HAMPER THE INDUSTRY and POSSIBLY END THE VIABILITY of California’s lithium industry before it starts.

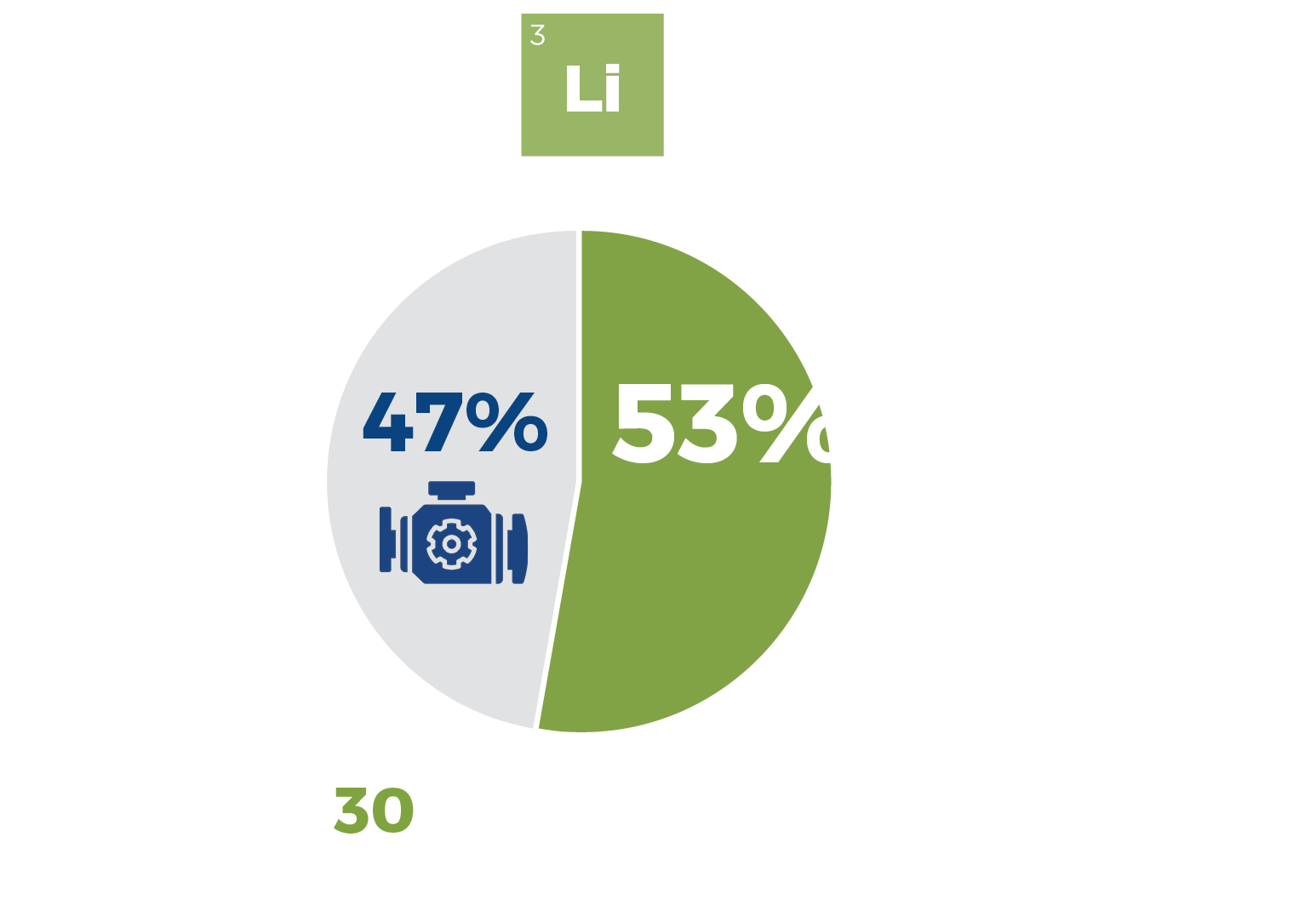

California Lithium must be positioned to face global competition

Global market & lithium realities demands a more flexible tax

To STAY COMPETITIVE with the global lithium market, any tax should be REASONABLE AND FLEXIBLE, aligned with the volatility of the new, still-forming California. lithium market.

An overly aggressive flat tax is not responsive to the realities of the global Lithium market with constantly changing prices.

A high flat tax ignores the unique facts that different grades of Lithium sell for vastly different prices.

As conceived this flat tax would disincentivize investment in California, and could stall a vital industry before it even starts. It could lead users (electric vehicle and battery makers) to buy lithium elsewhere without high incremental taxes, placing jobs, local suppliers, and the potential tax base at risk and the environmental benefits of producing brine lithium in California.

We enthusiastically support revenue from this tax being applied to local impacts and needs in Imperial County only.